Do one thing every day that scares you.

Core Principles

Risk Management

Taxes

What is Risk and How Do We Manage It?

Risk is simply a way to describe the probability that something bad will happen.

Why Should You Trust Me?

My entire career has been built around risk management, ensuring that we don't risk losing "the house," thereby ensuring the company's survival. That was a significant part of it, but there's so much more. I saw the software world gaining momentum in 2011, which is why I shifted my focus to becoming a software engineer. I anticipated the data/AI revolution in 2017, which led me to pursue a degree in data science.

Why did I foresee these changes?

I understood probabilities and history.

Every 10-25 years, there's a "revolution," meaning a systematic change in what drives the world forward. Understanding the history of these changes and observing the evolution of computing over the last 100 years, it was quite likely that these shifts would occur.

These were significant life decisions, and they are easy to point out, but I believe every decision you make is based on probability, even if you don't consciously think of it that way.

How to Measure Risk and Reward?

There are countless models for calculating risk and reward mathematically. Some are complex and delve deep into theory, but others are simple and can be used by anyone in real-time with a little practice. I will provide two practical ways to assess risk and reward. These calculations are straightforward and accessible to everyone. If you think you cannot do it, please message me; we will work it out together.

First steps:

What would happen in the worst case?

What would happen in the best case?

What would happen in the most likely case?

Now we have established the basic framework for determining probabilities and rewards. Let's use two simple examples:

Driving recklessly.

Financial investment.

There are two methods I prefer for evaluating risk and reward: the Expected Value (EV) of all outcomes and the Risk-Reward Ratio (RRR). Usually, these two measures will agree, but sometimes they might differ. The RRR is generally used for quick calculations, while the EV offers a deeper understanding of potential outcomes.

Example 1 (Reckless Driving):

Let's consider an example of reckless driving, simplifying it to just two possible outcomes.

Outcomes:

P(best_case) = Arriving 1 minute earlier

P(worst_case) = Causing a crash and being 2 hours late (120 minutes)

Probabilities (Risk):

P(best_case) = 0.99 (99%)

P(worst_case) = 0.01 (1%)

Returns in minutes (Reward):

R(best_case) = 1

R(worst_case) = -120

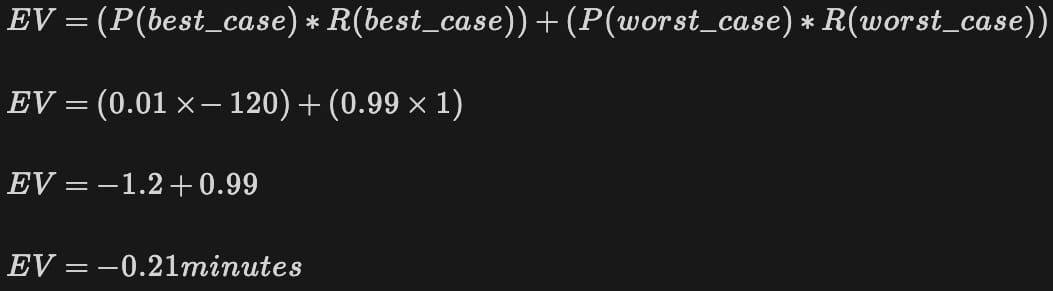

Expected Value:

The expected value from the investment is the probability of an event happening multiplied by the returns or rewards.

This means that on average you are expected to lose 0.21 minutes (12.6 seconds) each time you drive recklessly in this scenario.

Risk-Reward Ratio:

The rule of thumb is that as long as the Risk-Reward Ratio is over 1, it is worth pursuing. With an expected value greater than 0, it is generally considered worthwhile.

Since the EV is less than 0 and the RRR is less than 1, both equations suggest it is not worth the risk of reckless driving for the sake of arriving faster.

Example 2 (Buying Apple Stock):

Let’s assume we are investing in Apple. These numbers are hypothetical, including both the probabilities and the potential returns. We cannot know the future, but we can use assumptions and past data to predict possible outcomes.

Assumptions:

You have $1,000 to invest in one stock and will hold it for 5 years.

Outcomes:

P(best_case) = They continue to be the leading phone provider and grow their user base for the next several years. (Massive Returns)

P(middle_case) = They maintain the same market share with minor innovation. (Slightly positive returns)

P(worst_case) = They never innovate again and they crash like Blackberry. (End with $0)

Probabilities (Risk):

P(best_case) = 0.05 (5%)

P(middle_case) = 0.94 (94%)

P(worst_case) = 0.01 (1%)

Returns in dollars (Reward):

R(best_case) = $10,000

R(middle_case) = $3,000

R(worst_case) = -$1,000

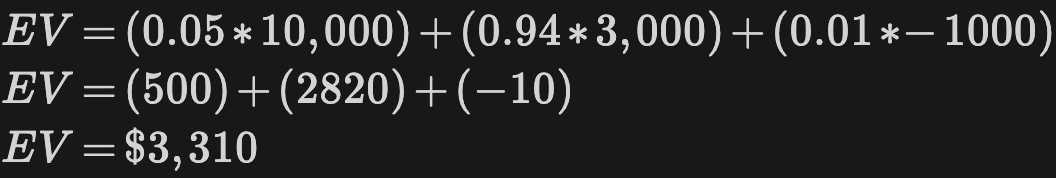

Expected Value:

If our assumptions about the probabilities are accurate, we would expect to have $3,310 at the end of the 5 years.

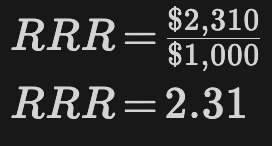

Risk-Reward Ratio:

In this example, because there are three possible outcomes, our Potential Reward will be our Expected Value minus our starting value. This differs from the binary option in the previous example.

Potential Reward = $3,310 (ending value) - $1,000 (starting value) = $2,310 (return)

Potential Risk = $1,000 (starting value)

So, in this example, both equations indicate that the investment is worthwhile since the EV is greater than 0 and the RRR is greater than 1.

The overarching goal is to approach risk logically, neither being overly risk-averse nor excessively risk-tolerant, but to weigh the options and trust the mathematics.

My Biggest Lesson

The things we fear often aren't as bad as we imagine. We are adept at causing ourselves to spiral when weighing options, especially if one potential outcome seems much worse or scarier than the other. It's okay to be afraid, but if a risk-reward analysis suggests you should proceed, then taking that leap is the first step. It’s always possible that you didn't accurately weigh the probabilities upfront. You will receive more information and faster feedback if you just go for it. Be willing to take risks; it can change your life.

My entire career has revolved around being proficient at assessing the risk of losing money against the potential reward of making money. The most important lesson is to maximize the ratio or expected value, not to minimize the risk.

There are times in life when you should become more risk-averse, but you still need to perform the analysis. You can always use a higher threshold to decide which option to choose, but the analysis is the crucial part.

Maximize the Ratio Every Day

Here's some practical advice that I might have needed in the past and might still need today: Consider talking to that stranger. While some people thrive on this and others dread the thought, the risk is minimal, and the rewards could be substantial. You know nothing about the person or their situation. They could be the perfect connection for whatever you need at that moment, but you won't find out unless you're willing to take that small risk.

I encourage everyone to take more of these small risks in life. Then, when big decisions arise, you'll be well-prepared with more data on how perceived risk can impact your life.

Weekly Poll

Interesting Stuff

If I lost you with all of my probability talk above take a look at this video. It should help you out!

Cleaning Up

Legal disclaimer (aka be an adult!): This is NOT financial advice and I am not responsible for your financial decisions and outcomes. I appreciate all of you but do not be stupid with your money and blame me. This is for educational purposes and every situation is specific and different. I do not have one, but if you need personal help with finances then get a fee-based Financial Planner. They will help you with long term goals.

Product links in this article are affiliate links. I will receive a commission if you purchase using the links. This will come at no extra cost to you but will go a long way in helping me keep this newsletter free.